The Virus, The Economy and the Property Market

As the COVID-19 pandemic has escaped China and swept into the western world, we’ve also experienced a surge in reports, analysis and opinion on how this unprecedented event will affect our lives. One of the great strengths of our democracy is freedom of the press, but the downside of this is that most stories will be reported, regardless of how baseless, shallow or exaggerated they may be. I’m not an expert on COVID-19 or the economy, nor am I a super genius like Donald Trump’s uncle, but I am an expert in my field and a student of history. I thought it might be worthwhile to share my best analysis based on wide reading and a collection of facts from reputable sources.

My main objective here isn’t to perfectly predict the future or make people complacent. I realise that there are many people and businesses hurting right now, and none of what I write here diminishes that. I also strongly recommend you follow government health advice; if we all strictly adhere to it, we will get this in check as quickly as possible and limit the loss of lives and damage to our economy. I think, however, that it’s worthwhile to give context and perspective at a time where events are most uncertain and where sentiment is at its most negative. We’re at our lowest ebb now, but there’s reason for sensible optimism. Remember - “things are never as good or as bad as they seem”.

The Virus

Australia is currently in the exponential growth phase of the virus, and is likely to reach its peak number of cases in 2-4 weeks. This is based on the experience of countries such as China and Italy ahead of us in the pandemic, and the widespread application of social distancing underway in Australia. Deputy Chief Medical Officer Nick Coatsworth says we should expect to see the outcome of these measures in the next 7-10 days. The government believes that if social distancing achieves 75% less exposure, then the infection rate will fall below 1 per person, which will send the virus into a death spiral of falling cases. This timeline may be out if the measures applied over the last 7 days are not effective enough, and a more drastic lockdown is required, however, this will only be a matter of extra weeks, not months. Ultimately, if numbers continue to dramatically increase, then it will eventually be brought into check by harsher measures and increased community compliance (out of fear if not obedience).

Once numbers have peaked, I would expect that the current social distancing measures and domestic travel restrictions in place will remain for a further 2 months, to lock in the decline in cases and prevent new outbreaks. Bars, restaurants, gyms etc. are likely to come back in action in July, albeit with ongoing restrictions. Mass gatherings will be interesting – there will be huge pressure on the Government to allow major sports to restart. With rolling outbreaks across the world over the coming months, International travel will remain off limits until a vaccine is rolled out or an effective antiviral can massively lower the mortality rate.

Here is a useful article on case number modelling. Some of the reports in the media speculating about millions of infections in Australia are wildly inaccurate, factoring in absolutely no changes in societal behaviour and without any reference to what is happening in infection numbers in other countries. I read one ‘report’ yesterday modelling a rate of 300,000 cases per day in Australia. This would be 20 times worse than the worst recorded days in the U.S and China, without any allowance for population size! It’s irresponsible fear-mongering at best.

We have reason to be cautiously optimistic in Australia. While we haven’t got everything right, we have been able to:

Test much more widely than most other countries. 178,000 tests had been conducted up to 26th of March.

Conduct effective contact tracking for most cases. Over half of Australian cases were acquired overseas and community transmission appears to be low.

Australia’s mortality rate is extremely low versus other countries, which suggest we are identifying more cases than other countries and do not have as high a rate of undetected transmissions.

Australia has cause for cautious optimism, given our mostly effective response to the crisis to date.

The Economy

The economy is experiencing an extremely rapid and deep fall in demand, with sectors such as aviation, tourism, hospitality, health and fitness, sports and the arts suffering an almost instantaneous and complete drop in demand. JP Morgan estimates this will take over 10 per cent out of GDP for the quarter, and in all likelihood it will be more.

This is manageable for a wealthy society like Australia, as long as the economic damage isn’t too great and the losses are spread out across the community. This is the main challenge faced by the government and the community. We are seeing some encouraging signs. The government is seeking to ‘socialize’ the losses directly by supporting unemployed workers and businesses that have stood down. We are in a good position to do this due to a strong balance sheet and low government debt, but the federal government is rightly being cautious about taking all of the economic responsibility for the crisis, and potentially doubling or even tripling Australia’s debt over a 3-6 month period.

The response from businesses and society has been positive, with workers, landlords and banks preparing to absorb some of the losses as well as businesses, who are arguably the most vulnerable in this situation. The government will also need to find a way to spread the pain across to public sector workers, who already enjoyed higher wages and better conditions than the private sector, and who are largely quarantined from the fallout.

The government is also aiming to keep as much of the economy functioning as it can within the health advice. If Australia can achieve this while still quashing the virus, this will be a better outcome than a full lockdown. The lockdown is a seductive option, and may still be required, but it won’t allow restrictions to be relaxed quickly either. The economic impact of a full lockdown is basically unknown, and I’m wary of the increasing clamour for it from people with no skin in the game.

Restaurants and tourism are two of the hardest hit areas due to COVID-19. The surge of new food and beverage businesses over the last few years had reached almost bubble proportions and will likely face a major readjustment post-crisis.

Longer-term, its very difficult to predict the coronavirus’ impacts. However, it has already been a trigger for a reassessment of share market value, and it is likely to be a tipping point for looming crises in certain sectors, across the Australian and global economy. Sectors such as retail and food & beverage, which were already being hit with oversupply and shrinking margins, are likely to see further consolidation as marginal businesses go under and disposable income across the country shrinks. This will cause short-term pain and heightened unemployment as a structural readjustment occurs, but is probably beneficial long-term. Surely I’m not the only one who has been thinking that there’s far too many cafes, restaurants and bars around these days, and wondering how most of them were making money given low sales, high rents and high staff costs.

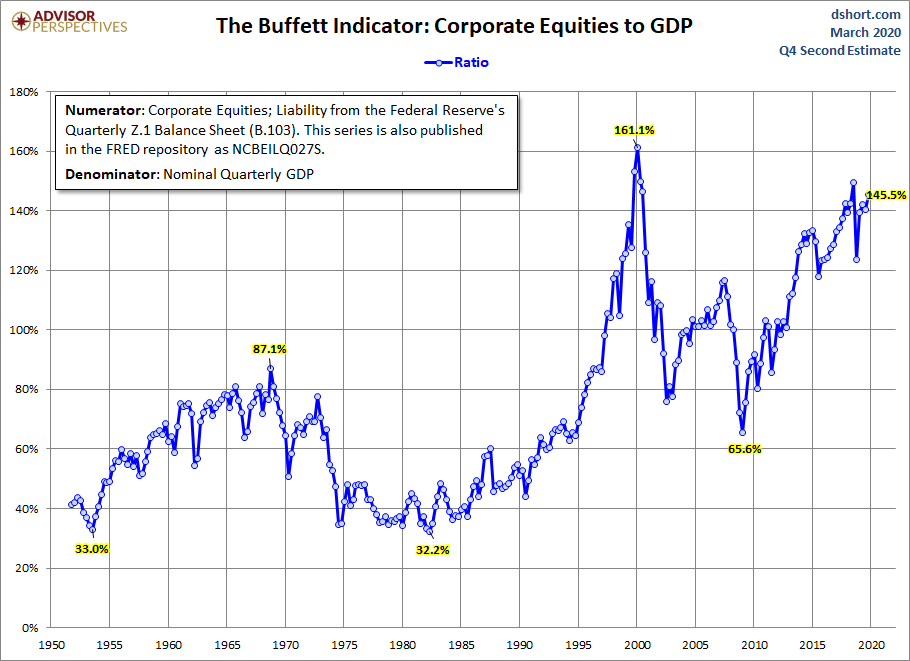

Share markets worldwide have been considered overvalued for some time now, and a correction should have been expected. Based on the famous Buffett Indicator, which measures total company value against national GDP, the U.S share market was almost 50 per cent overvalued prior to the recent correction. The Australian share market was 25 per cent overvalued. This has been a necessary correction, and the U.S market is still 20% overvalued by this measure, suggesting there is more pain to come.

The U.S Share Market as a percentage of GDP just prior to the COVID-19 crash.

COVID-19 has hit Europe hardest so far, and the two governments most affected are also two of most highly indebted. According to the OECD, Spain has government debt of 117 per cent of GDP, while Italy strains under government debt of 157 per cent of GDP. With Italy’s unemployment rate already at 10 per cent and Spain’s at over 14 per cent, the economic consequences of this crisis will put serious pressure on the Italian and Spanish governments and their societies, as well as the stability of the EU itself and the single currency.

The Property Market

Just like the reporting on the virus and the economy, the impact on the property market is subject to considerable speculation. Some reports suggest falls of 20 per cent, while others predict no impact at all. Prior to the pandemic, the direction in most cities was upwards, fuelled by interest rates at record lows, easier servicing from lenders and limited supply of housing stock. The immediate impact of the crisis has been to hit auction clearance rates and reduce the number of buyers in the market, as people either adopt a ‘wait and see’ approach, or pull out of purchasing due to unemployment. The next stage will be a withdrawal of sellers from the market, which may balance the loss of buyers and lead to a ‘hibernation’ of transactions.

What will be the result? It’s difficult to predict exactly. I expect some sellers already on the market will be forced to discount, leading to some price falls. This may be higher in prestige areas and markets that are already overvalued, such as Sydney. Markets that are heavily reliant on tourism, particularly international tourism, may take a heavier hit, based on the impact of 12 months or more of closed borders. With government support, plentiful credit and accommodating lenders, most owners should be able to ride out short-term pain, so I expect panic selling to be limited.

In the medium term, the impact is also tricky to assess. AMP Chief Economist Shane Oliver has linked the health of the market to how far unemployment rises – a 7 per cent unemployment rate is likely to cause a 5 per cent fall in the property market, before a recovery driven by cheap money forces prices up again. A more prolonged, painful recession would alter this equation, leading to a longer period of price falls and a slower recovery.

What can history tell us here? Are big sustained falls possible? Over 90 years the Australian property market has had a stellar run, increasing 16-fold in value in real times. Nonetheless, from the start of the Great Depression in 1929 until the end of the Second World War, real houses prices fell 50%. Real prices also went sideways during the oil shocks of the 1970s and recession of early 1980s, and were flat for 1990-1995 following the ‘recession we had to have’. Finally the GFC saw a dip in house prices, but given its limited impact on Australia its effects were modest.

Source: ABS, AMP

This isn’t global depression, it’s not a world war, an inflation shock or a credit crunch. It’s a sizeable but short (in economic terms), government-mandated demand shock that will be reversed once the virus is under control. At the end of it, we will have the same people, skills, assets, infrastructure and resources that we did at the start, but the adjustment to the changed economic circumstances we face as a nation may take a while and reduce our output.

In terms of property advice, it’s simple. Focus on quality - buy flexible, well-built properties in locations of strong consistent demand but limited supply. And focus more than ever on value. If we do have a lengthy downturn, then easy gains will be harder to come by, so what you pay for the property and what income you’re getting from it will be critical to your return. For example, while I wouldn’t have bought an $1.5 million apartment which returns $750 per week before the pandemic, I definitely wouldn’t now.

Is there really much value to be had paying $1.5 million for a 2 Bed 1 Bath apartment in Sydney?

Some Final Thoughts

One of my hopes from this crisis is that we will make financial resilience a greater priority. While it’s upsetting to see people being made unemployed, it’s also frustrating to hear people complain that after one week out of week they can no longer afford rent, food, or other basics. We live in one of the richest countries in the most abundant time on earth, and yet some people have no buffer whatsoever to deal with any kind of shock, becoming immediately reliant on the government to save them. For some people this situation is unavoidable, but for many, it’s a case of making choices - choices which prioritized spending on houses, cars, clothes, lifestyle and holidays, instead of saving and being self-reliant.

I’m much more sympathetic to businesses that have invested, taken risks and employed staff, but are now faced with a massive loss of revenue and an uncertain future. If you are in a strong financial position, then now is a great time to share some (responsible) love. Order takeaway food (directly through the restaurant so they keep all the money), keep an online subscription for your gym or pilates studio, and reschedule rather than refund domestic travel.

And get ready to spend up locally, travel domestically and celebrate appropriately once the restrictions are done!